By Carmen Rodgers

Elmore/Autauga News

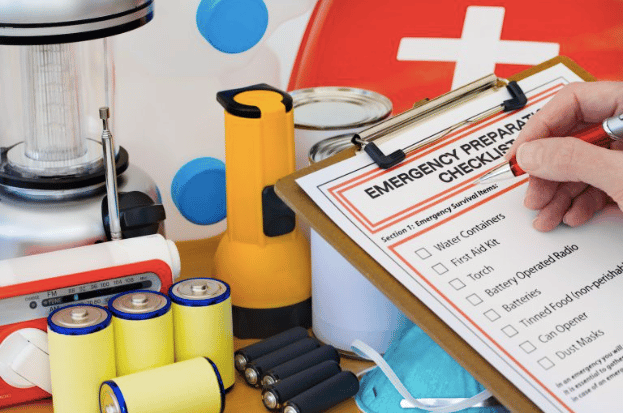

Alabama has certainly seen its fair share of severe weather of the past few months. Severe weather is the exact reason that state, county, and local government will host the Severe Weather Preparedness Sales Tax Holiday beginning at 12:01 a.m. on Friday, Feb 24, which is the last full weekend of the month. The tax-free weekend will end at midnight on Sunday, Feb. 26.

According to the Alabama Department of Revenue, this event gives shoppers the opportunity to purchase certain severe weather preparedness items free of state sales tax.

Both Autauga and Elmore Counties are participating in the tax-free holiday. In some towns and cities in the state, a local sales tax may apply; however, Millbrook, Prattville, and Wetumpka are participating in the tax-free holiday.

The tax-free weekend covers many items. However, there are many items that are not tax exempt. For example, belts are on the list of tax-free items, however, belt buckles are not considered eligible.

Below is a complete breakdown of tax-free eligible items, provided by the Alabama Department of Revenue.

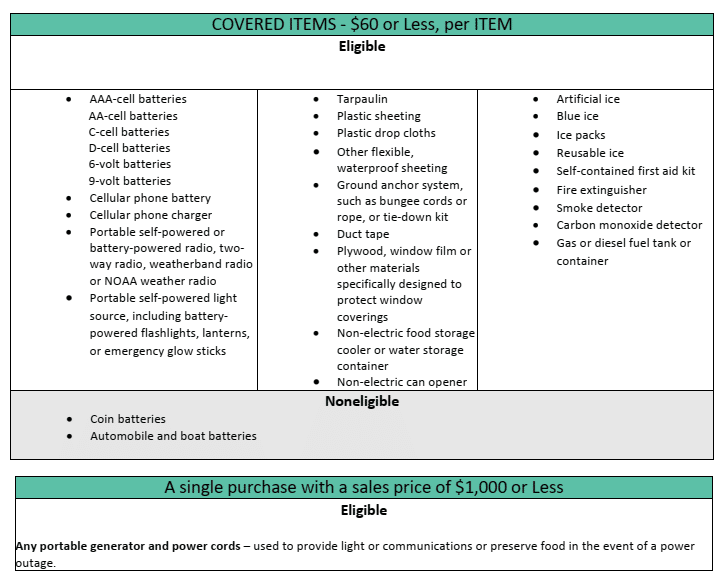

Each eligible item must be $60 or less. Eligible items include AAA-cell batteries, AA-cell batteries, C-cell batteries, D-cell batteries, 6-volt batteries, 9-volt batteries, cellular phone battery, cellular phone charger, portable self-powered or battery-powered radio, two-way radio, weather band radio, or NOAA weather radio, portable self-powered light source, including battery powered flashlights, lanterns, or emergency glow sticks, tarpaulin, plastic sheeting, plastic drop cloths, other flexible, waterproof sheeting, ground anchor system such as bungee cords or rope, or tie-down kit, duct tape, plywood, window film or other materials specifically designed to protect window coverings, non-electric food storage cooler or water storage container, non-electric can opener, artificial ice, blue ice, ice packs, reusable ice, self-contained first aid kit, fire extinguisher, smoke detector, carbon monoxide detector, gas or diesel fuel tank or container.

Noneligible items include coin batteries, automobile, and boat batteries.

A single purchase with a sales price of $1,000 or Less

Also eligible is any portable generator and power cords, less than $1000, to be used to provide light or communications or preserve food in the event of a power outage is also eligible for tax-free status.

For more information, contact the Sales and Use Tax Division at 334-242-1490 or 866-576-6531.